The Headlines:

- Double-digit yields in tech hubs vs. 3-4% in global markets

- Massive infrastructure boom creating instant value appreciation

- Scale that dwarfs other emerging markets

- Early-mover advantage in tomorrow's prime locations

1. Double-Digit Yields in Tech Hubs

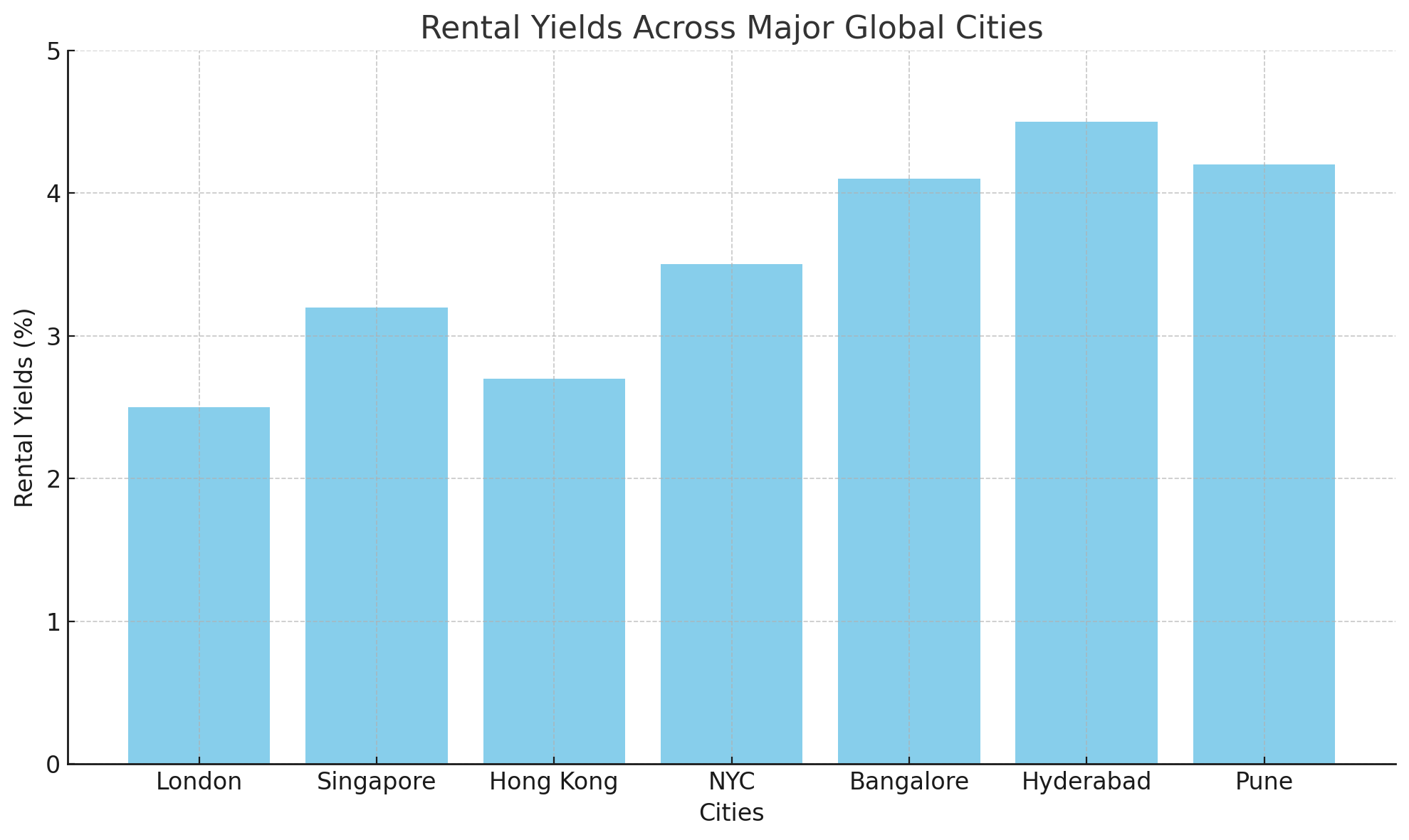

Global property yields tell a compelling story. London's prime areas struggle to reach 4%, Singapore hovers around 3%, and Hong Kong barely touches 3%. Meanwhile, India's tech corridors are consistently delivering returns that seem almost too good to be true – but they're very real.

The contrast is striking when examining major tech hubs. Bangalore's Electronic City consistently generates 7-9% yields, while Hyderabad's HITEC City and Pune's Hinjewadi maintain strong 7-8% yields. Even Mumbai's premium Bandra Kurla Complex commands impressive 6-8% yields. These aren't speculative investments relying on unknown businesses – these properties are leased to global tech giants like Google, Microsoft, IBM, and Infosys, providing stable, long-term rental income that's increasingly rare in global markets.

Moreover, the demand isn't slowing down. Tech companies are expanding their Indian operations at an unprecedented rate, creating constant pressure on premium office space. This dynamic ensures that yield compression, a common concern in mature markets, remains a distant threat in India's tech hubs.

2. The Infrastructure Boom

India is experiencing an infrastructure revolution that's creating value in real time. This isn't about promised development – it's about projects being completed and immediately impacting property values. Across the country, 27 cities are building or expanding metro systems, while over 50 airports are under construction or expansion. The ambitious 100 smart cities initiative, coupled with multiple industrial corridors connecting major economic centers, is reshaping the urban landscape.

Consider the transformation of Pune's Hinjewadi, which evolved from farmland to a thriving IT hub in under a decade. Hyderabad's Nanakramguda emerged as a premium financial district delivering 8-9% yields, while Bangalore's Outer Ring Road developed into a world-class office corridor with 8-10% yields. This infrastructure boom isn't just improving connectivity – it's creating entirely new investment opportunities. Areas that were considered peripheral three years ago are now commanding premium rates, delivering exceptional returns to early investors.

3. Unmatched Scale and Growth

The sheer scale of India's market fundamentals sets it apart from any other investment destination. With 440 million millennials driving rental demand and an urban population projected to reach 600 million by 2030, the demographic dividend is impossible to ignore. The middle class is expanding by 25 million annually, while the working-age population grows by 12 million per year.

The commercial growth story is equally compelling. The IT sector maintains a robust 8-10% annual growth rate, while the e-commerce market expands at an impressive 30% yearly. Data center capacity is doubling every two years, and co-working spaces are experiencing 50% annual growth. This isn't just growth – it's transformation at a scale that creates sustained demand across all real estate segments.

4. Early-Mover Advantage in Emerging Corridors

Today's emerging business districts are tomorrow's prime locations, offering a rare opportunity to position investments ahead of the value curve. The pattern is clear and repeating across major cities. In Bangalore, Electronic City Phase 1 early investors saw 300% appreciation in 5 years, while Whitefield property values doubled in just 3 years after tech park completion. The Outer Ring Road continues to show 15-20% annual appreciation in prime locations.

Hyderabad tells a similar story of transformation, with HITEC City evolving from barren land to India's second-largest IT hub. The Financial District has seen property values surge 150% in 4 years, while Gachibowli maintains rental rate growth of 12% annually. Pune's evolution continues with Hinjewadi Phase 1 achieving full occupancy within 2 years of completion, and Kharadi showing rental rate increases of 40% in 3 years.

Looking Ahead: The Investment Imperative

The Indian real estate market presents a rare confluence of factors that savvy investors can't ignore. While global markets grapple with yield compression and saturated demand, India's growth story is just beginning. The combination of superior yields, rapid infrastructure development, unprecedented scale, and emerging corridors creates an opportunity set that's increasingly rare in global real estate.

Conclusion

India's real estate market represents a unique moment in time where multiple growth drivers align to create exceptional investment opportunities. While global markets struggle with modest returns, India's emerging corridors are delivering performance that demands attention. For investors seeking both yield and appreciation potential, India's property market offers a compelling proposition that's becoming increasingly hard to ignore.

What are your thoughts on these yield differentials? Are you seeing similar opportunities in other emerging markets? Share your insights and experiences below.