As trade wars escalate and the U.S. imposes sweeping tariffs on allies and rivals alike, global investors are scrambling for stability. The latest tariffs, targeting

$360 billion in imports (including steel, aluminum, and electric vehicles), have sent shockwaves through Western markets, amplifying fears of inflation and recession

[1]. Amid this chaos, India’s real estate market is emerging as a beacon of resilience and luxury is leading the charge.

Once dismissed as a niche segment, India’s luxury housing market now commands

7-9% of the sector, with sales in cities like Delhi-NCR soaring by

45% in 2024 alone

[2][5]. For savvy investors, this isn’t just a trend—it’s a golden opportunity to capitalize on “affordable luxury” while Western markets buckle under political and economic strain.

Why India’s Luxury Market Outshines the West

A luxury apartment in Mumbai costs

$150,000–$300,000, while a comparable unit in New York or London averages

$1.5–$3 million. Yet India’s luxury segment is growing faster: sales surged to

21% of total residential units in 2024, up from just 7% in 2019

[3].

Luxury apartments in India deliver

2.5–4% annual rental yields, outperforming Western cities like Paris (1.5%) or Tokyo (2%)

[4]. Mid-segment properties perform even better (4–6%), but the luxury market’s exclusivity and scarcity premium make it a hedge against inflation

[4].

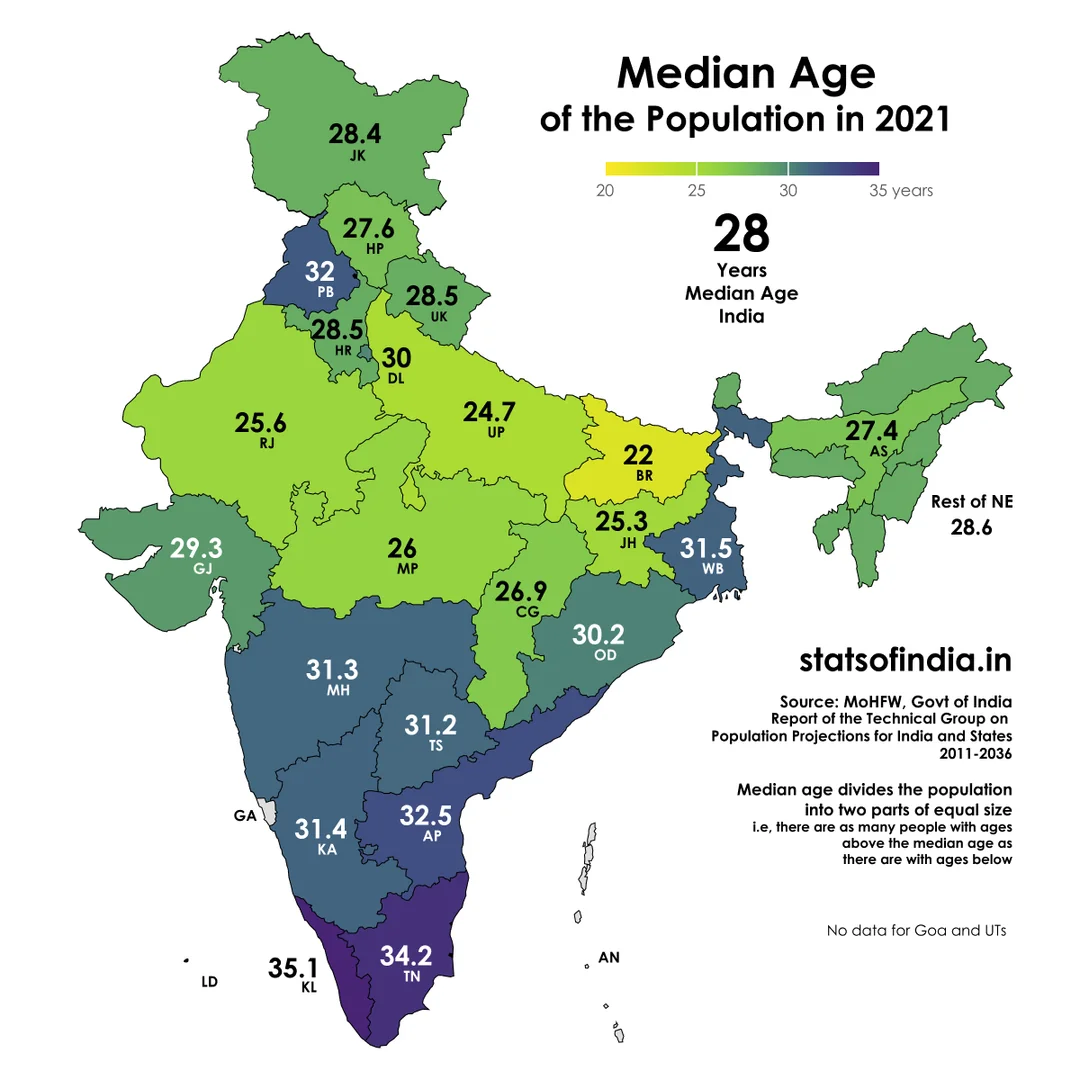

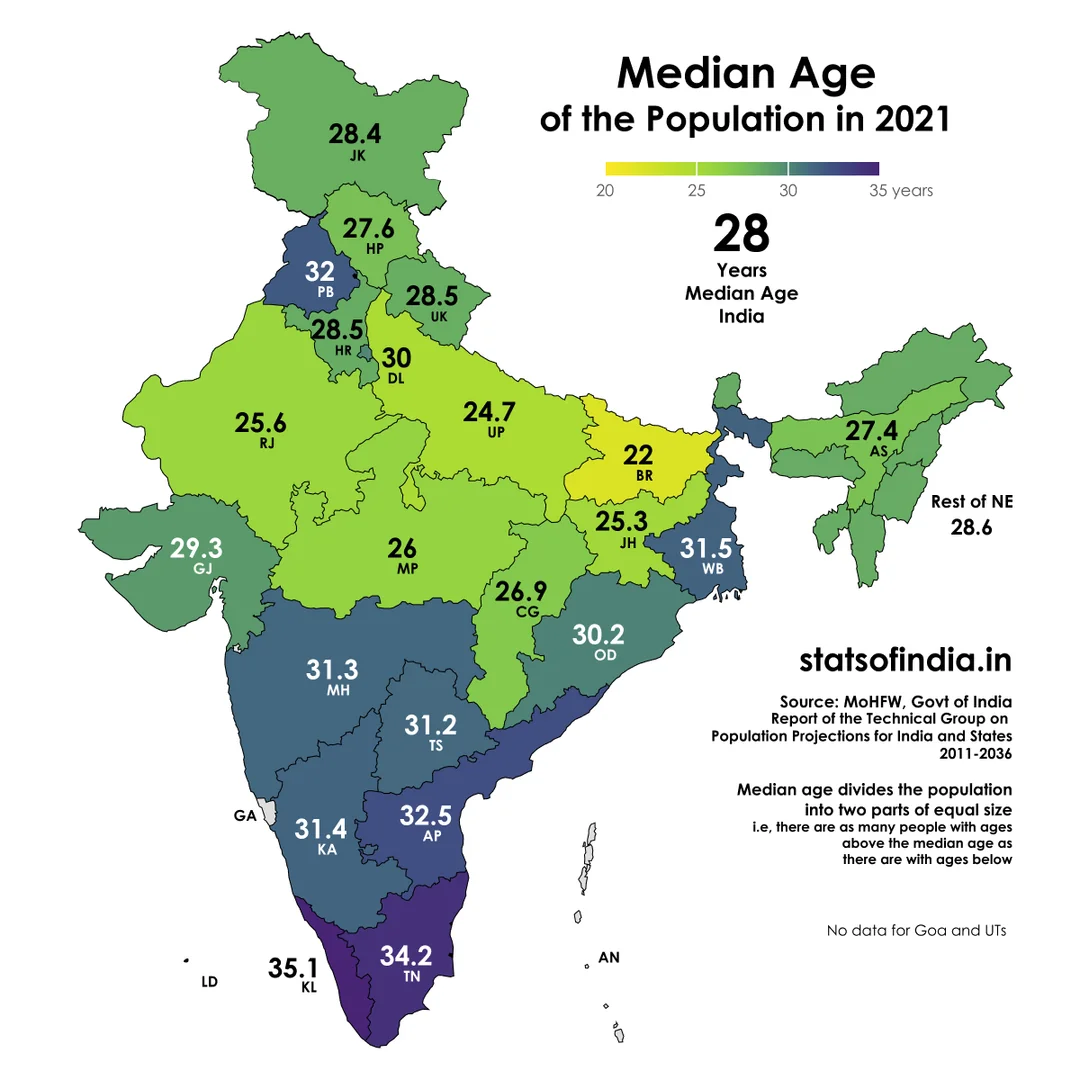

India’s median age is

28.4, with 600 million people under 30. Urbanization is accelerating, with

40% of the population expected to live in cities by 2030 [5]. This demographic surge fuels demand for premium housing, co-living spaces, and tech-enabled communities.

Tariffs, Turbulence, and the Case for India

Tariffs, Turbulence, and the Case for India

The U.S. tariffs—part of a broader “de-risking” strategy—are reshaping global trade. While European and Asian exporters brace for losses, India’s real estate sector benefits from two trends:

1. Flight to Safety: Investors are pivoting to emerging markets with stable growth. India’s GDP is projected to expand

6.5% in 2025, dwarfing the U.S.’s 1.5%

[6].

2. Government Backing: Policies like

100% FDI in real estate and the

PMAY affordable housing scheme (which unlocked $22 billion in 2024) reduce risk for foreign investors

[5].

Meanwhile, Western markets face headwinds: U.S. housing sales declined

12% in 2023 amid rising mortgage rates, while India’s sales grew

31% [6].

How to Capitalize on India’s Luxury Boom

Target Tier-2 Cities: Luxury isn’t confined to Mumbai or Delhi. Cities like Pune, Hyderabad, and Ahmedabad are witnessing

18–25% annual price appreciation due to IT growth and infrastructure projects

[3].

Focus on “Smart Luxury”: Properties integrated with AI-driven security, renewable energy, and IoT amenities appeal to India’s tech-savvy elite. Developers like Lodha and Godrej are already pioneering this trend

[3].

Leverage NRI Demand: Non-resident Indians (NRIs) account for

15% of luxury sales, driven by emotional ties and favorable exchange rates

[4].

Conclusion: Time to Rethink “Luxury”

India’s real estate market isn’t just catching up to the West—it’s redefining it. As tariffs destabilize traditional safe havens, the subcontinent offers a rare mix of affordability, growth, and demographic momentum. The American Dream may be fading, but India’s “affordable luxury” is just beginning to shine.

Sources:

[1] Luxury vs. affordable housing demand

[2] NCR luxury sales surge

[3] Luxury market growth and smart tech adoption

[4] Rental yield analysis

[5] Government policies and FDI

[6] Sales growth comparison