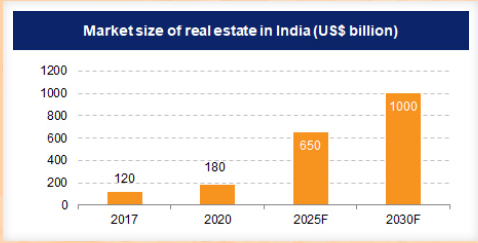

The global real estate landscape is shifting—and India is poised to dominate the next decade. By 2030, India’s real estate market is projected to reach

India’s Growth is Unstoppable—And It’s Just Getting Started

India’s urban population is set to grow by

Contrast this with the West: Aging populations, inflation-driven construction costs, and climate-related property risks (e.g., coastal flooding) are stifling growth. In the U.S., home ownership rates have flatlined near

The Middle Class is Rewriting the Rules of Wealth

India’s middle class—already

In contrast, Western middle-class wealth is eroding. U.S. housing affordability hit a

The Clock is Ticking—Here’s Why You Can’t Wait

India’s real estate boom isn’t a distant future event—it’s happening now. Consider these urgent signals:

Luxury demand is surging : High-net-worth Indians drove a30% spike in premium property sales in 2024 [1].Tech is turbocharging growth : Data centers, co-working spaces, and smart cities are attracting$25 billion in annual FDI [3].Western investors are racing in : Blackstone, Brookfield, and Goldman Sachs now own15% of India’s top commercial assets [1].

Climate risks : 30% of U.S. coastal properties could lose value by 2050 due to rising seas.Demographic decline : Europe’s population aged 65+ will hit28% by 2030 , shrinking labor forces and housing demand [3].

How to Protect Your Family’s Legacy

The stakes are clear: Ignore India’s real estate revolution, and your heirs may inherit a depreciating Western portfolio. Act now, and you could secure generational wealth. Here’s how to start:

Diversify into tier-1 Indian cities : Focus on Bangalore (tech), Hyderabad (IT/Pharma), and Pune (manufacturing) [3].Prioritize RERA-compliant projects : These offer transparency and lower risk.Leverage REITs and fractional ownership : Platforms like Embassy REIT provide low-entry access to premium assets [1].

Final Warning: The $1 Trillion Opportunity You Can’t Afford to Miss

India’s real estate market isn’t just a “high-risk bet”—it’s a

Sources:

[1] Exclusive-Blackstone mulls $4 billion-plus sale of Liftoff, sources say

[2] Trends in Private Equity investments in India - 2024 - Knight Frank

[3] Residential and Office Market - Jan - March 2024 - Knight Frank